In Brazil, the overriding need to meet consumer demand for electrical power in a safe way and with reduced rates poses a major challenge, given the need to design, build and operate a huge and complex system that can generate, transmit and distribute electrical power. Learn more about the Brazilian energy market and its particularities in this article.

Context

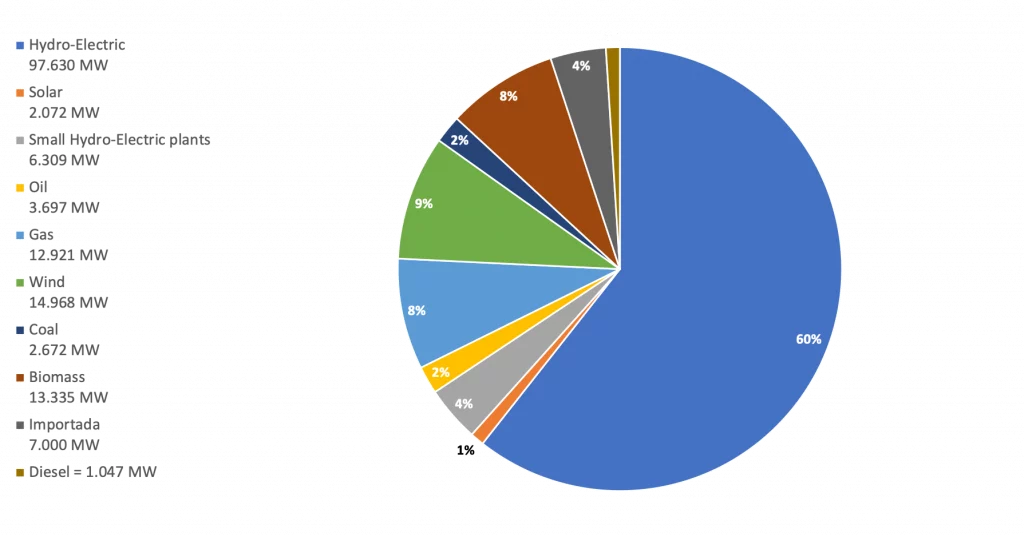

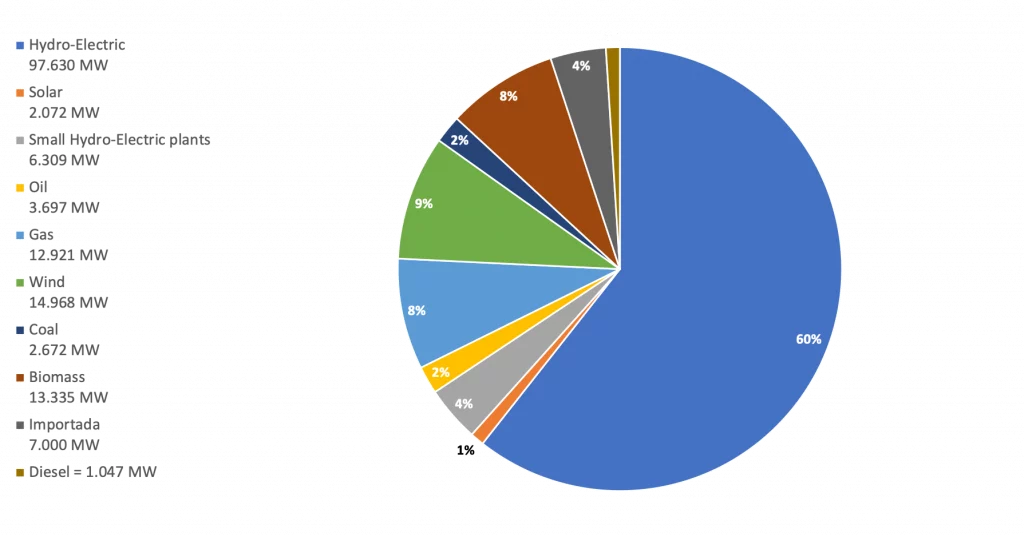

In Brazil, the main source of generation in 2020 (source: National System Operator) was:

- Hydro-electrical power, which provides 66,1% of the country’s installed operating capacity.Thermo-electrical power (natural gas, coal, fossil, biomass and nuclear fuels) at 22.7%.

- The rest came from wind farms (wind energy) and energy imported from other countries.

- The generators produce the energy and the transmitters transport it from the generation points to the consumer centers, and from there the distributors take it to the final consumer.

- There are also the suppliers, authorized to buy and sell energy to free consumers.

Brazil’s electricity sector has a different operating model to the rest of the world. Distribution is centralized, and the National System Operator is responsible for determining the generation level of the plants, in order to optimize resources and minimize costs, as well as to coordinate the transmission facilities (lines, sub-stations and other equipment).

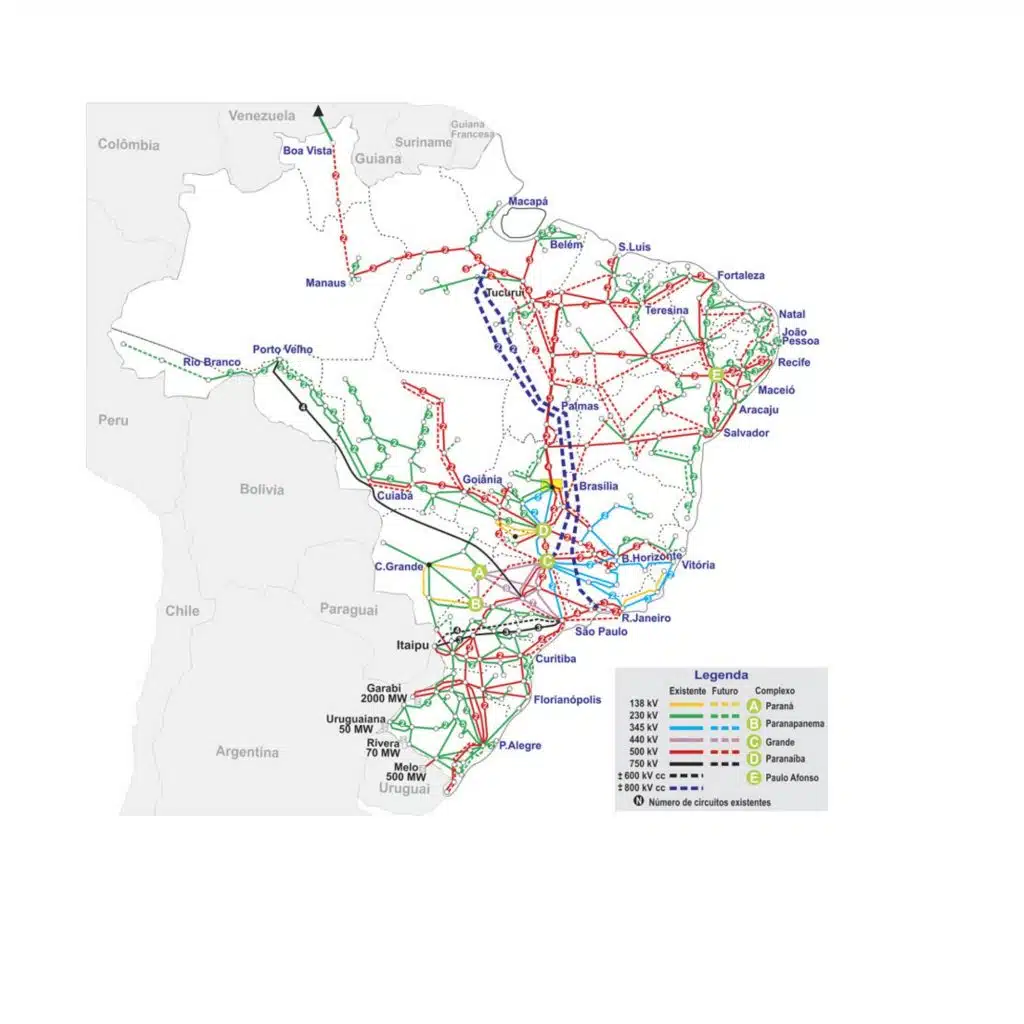

The Brazilian electrical system allows for an exchange of the energy produced in all the regions, except in the isolated systems, which are mainly in the Northern region. The transport of energy is possible by means of the National Interconnected System, a huge transmission network that is over 140,000 km long. Isolated systems have, over time, been gradually connected and now make up only around 2% of the whole system.

The country has enormous energy potential, especially when it comes to renewable energy, which is constantly undergoing technological and regulatory innovation.

Power Generation

Electrical power systems around the world have been going through a period of transition, focused mainly on the decarbonization of power grids. Although Brazil has an electricity generation system that generates power from predominantly renewable sources and has low emissions of greenhouse gases, the energy transition has affected the Brazilian Electrical System. Brazil faces the same challenges as other countries, mainly due to the greater participation of uncontrollable sources.

The Brazilian model of power generation is mostly hydro-electric. The predominance of hydroelectricity is justified by its economic competitiveness and by the abundance of this energy source in the country.

In February 2020 (source: CCEE) there were 875 hydro-electric plants in Brazil, 615 wind farms, 114 photovoltaic plants and 401 thermo-electric plants (with 286 biomass plants).

In recent years, the installation of wind farms, mostly in the northeast and southern regions, has grown quickly, increasing the importance of this type of generation to meet market demand. Thermal power plants, mainly located near key power centers, play a significant strategic role because they contribute to the safety of the National Interconnected System. These plants are introduced depending on the current hydrological conditions, allowing for management of the stocks of water stored in the reservoirs of the hydro-electric plants, to ensure future supplies.

The figure below shows the installed capacity:

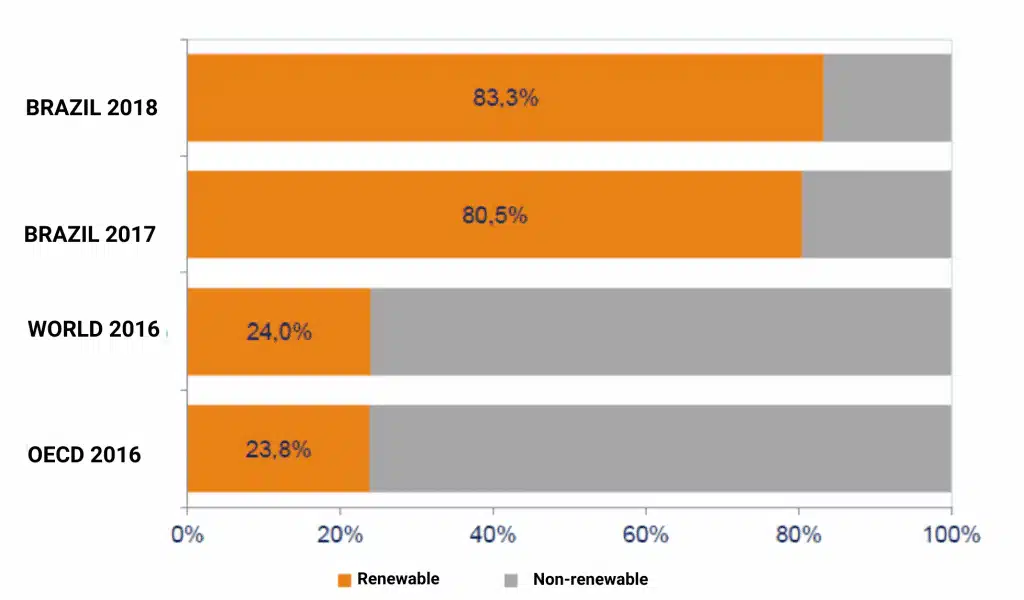

Brazil has a mainly renewable electric power grid, with renewable sources representing 83.3% of the domestic electricity supply. This is the result of domestic production plus imports that are essentially from renewable origins.

The use of renewable sources in Brazil is comparatively better than that of the rest of the world:

The Energy Transmission

The energy transmission system in Brazil is made up of a network of transmission lines that spreads throughout the national territory, which takes the electricity from the generating sources to the distribution companies.

Brazil’s power generation and transmission system is a huge hydro-thermo-wind system, mostly comprising hydro-electric plants with multiple owners.

The National Interconnected System is made up of four sub-systems:

- southern

- south-east central west

- north-east

- and most of the northern region.

Each of these is a region where the energy circulates freely. The line dividing each sub-market is determined by the exchange limits present in the transmission system.

The interconnection of electrical systems, by means of the transmission grid, allows the transfer of energy between the sub-systems, providing synergistic returns and taking advantage of the diversity between the hydrological basin systems. The integration of generation and transmission resources means market demand can be met safely and economically.

The operation and maintenance of the high voltage transmission lines are public, with long-term lease contracts that are remunerated through Annual Allowed Revenue and paid by all users of the National Interconnected System.

Currently, Brazil has 141,756 km of electricity transmission lines, spread throughout the country. The National System Operator is responsible for the control, monitoring and planning of the operation of the electricity generation and transmission facilities of the National Interconnected System, under the supervision of the National Electrical Energy Agency.

The wide expanse of the Brazilian system can be explained by the size of our the country and the way it has developed, with the country’s main hydro-electric plants being located at considerable distances from consumer centers.

The Electricity Distribution

Electricity distribution companies are responsible for receiving the high-voltage power from the interconnected transmission system, lowering it to commercial levels and getting it to the final consumer.

The public service of electricity distribution is provided by concessionaires, permit holders and authorized companies. There are currently 109 agents, of public, private and mixed economies, operating in the distribution market, which also sell to the captive consumer.

This is a natural monopoly with revenue (rates) regulated by the National Electrical Energy Agency.

Trading

The purchase and sale of energy are negotiated in the National Interconnected System (SIN). This means that, once the market agent (distributor, generator, sales agent, free or special consumer) becomes a member of the SIN, it can negotiate energy with any other agent, regardless of the physical restrictions of generation and transmission.

Business relationships in the current model are established in two spheres:

- The Regulated Contracting Environment.

- The Free Contracting Environment.

The Regulated Contracting Environment

The purchase and sale of energy in the Regulated Contracting Environment is formalized by means of contracts signed between the generators and the distributors, who take part in energy purchase and sale auctions held by the Chamber for Commercializing Electricity (CCEE).

These contracts have specific regulations for aspects such as the price of the energy, sub-market registration of the contract and supply term, not subject to bilateral changes by the agents.

In the regulated contracting environment are the captive consumers, those who purchase energy from the distribution concessionaires to which they are connected, each consumer unit pays only one energy bill per month, including the service of distribution and generation of energy, and tariffs are regulated by the Government.

The Free Contracting Environment

In the Free Contracting Environment, generators, importers and exporters of energy and free and special consumers are free to negotiate and establish contracts for the volumes of purchase and sale of energy and their respective prices.

Free consumers purchase energy directly from the generators or suppliers, by means of bilateral contacts with freely negotiated conditions, such as price, term, volume, etc. Each consumer unit pays a bill relating to the service of distribution by the local concessionaire (regulated rates) and one or more bills relating to the purchase of the energy (contractually negotiated price).

- Free Consumer: unit served at any voltage and with demand contracted with the distributor equal to or greater than 2 MW.

- Special Consumer: unit or set of consumer units located in a common area or with the same CNPJ [taxpayer contribution number], whose load is greater than or equal to 500 kW (total of the contracted demand) and connected at high/medium tension. The special consumer may contract only incentive energy, which is energy generated by solar, wind, biomass, qualified co-generation sources or by Small Hydro-Electric Plants. Energy consumption through these sources is subsidized, to encourage more sustainable generation (discount on the tariff for use of the distribution system –wire rates).

The activities to make the two types of electrical energy purchase viable in the SIN are operated by the Chamber for Commercialising Electricity (CCEE) and will follow regulations established by National Electric Energy Agency (ANEEL). All contracts signed in the free and regulated environments are registered with the CCEE.

Based on 2019 CCEE data, the free market had 7,317 consumer agents, both special (6,374) and free (943), equivalent to 16,881 consumer units, with a total energy demand of 171 GWh (30% of Brazil’s total energy consumption) in 2019.

Consumers

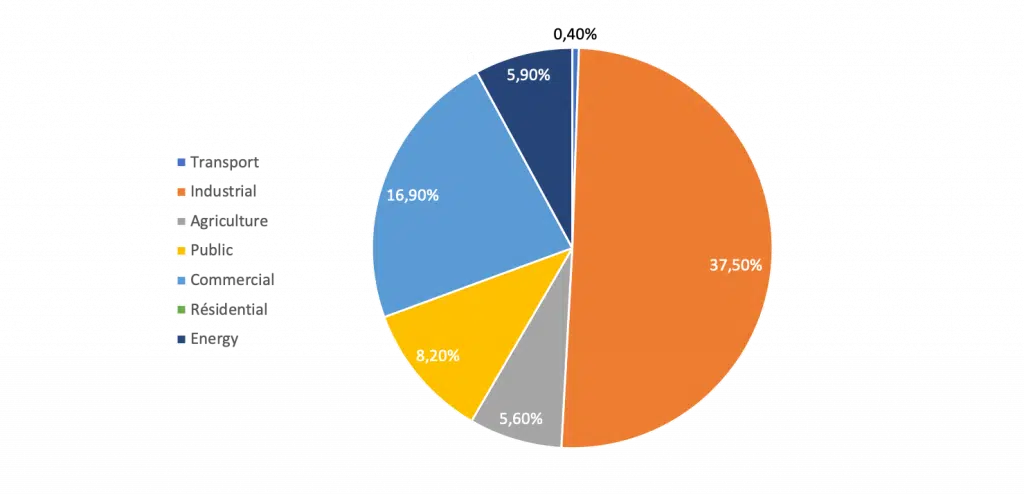

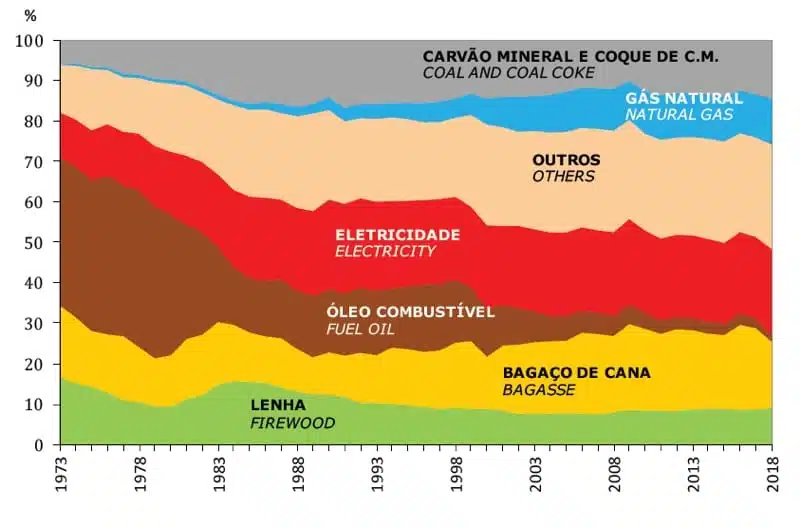

The figures below show the participation of the different sectors in electricity consumption in 2018 and the structure of energy consumption in the industrial sector:

The figure below presents Free Market consumption by branch of activity in 2019:

Rates

The value of the account paid by the consumer is made up of 10.70% sector charges, 29.00% taxes, 24.90% distribution, 4.10% transmission and 31.30% energy generation (Source: Brazilian Association of Energy Traders - ABRACEEL).

Almost 40% of the electricity bill is made up of taxes and sector charges, in other words, they do not directly interfere in the process of electricity consumption, which effectively depends on the services of generation, transmission and distribution.

"Spot Market"

All purchase and sale contracts entered into in the market – both Regulated and Free – must be registered with the CCEE, which measures the amounts effectively produced/consumed by each agent.

The Short-Term Market is the segment of the CCEE that calculates the differences between the amounts of electricity contracted by the agents and the amounts of generation and of consumption effectively verified and attributed to the respective agents.

Because of the predominance of hydro-electric plants in the Brazilian electricity generation system, mathematical models are used to calculate the PLD (Price of Settlement of Differences - Spot Price), which aims to find the optimal balance between the present benefit of water use and the future benefit of its storage, measured in terms of the expected fuel savings of the thermoelectric plants.

The calculation of the PLD is based on the “ex-ante” dispatch, that is, it is calculated using planned information, prior to the actual operation of the system. The values are determined on a weekly basis for each load level, based on the Marginal Cost Operation, limited by a maximum and minimum price in force for each calculation period and for each sub-market.

From January 2021, the PLD was calculated on an hourly basis by means of a new computational model that will bring greater detail to the energy system and its operational restrictions. The model will optimize the hydro-thermal dispatch of the current operating week on a daily basis and will identify the price of energy for all 24 hours of the following day.

In view of the above, it is expected that the projections of the system operation will approach the reality of energy production and consumption, considering an increasingly diverse electric matrix, with the increase in participation of intermittent, solar and wind renewable sources.

The new hourly pricing model will bring new contract formats and new business opportunities and should foster better demand risk management through the creation of new behaviour and strategies. Industries that have relevant energy costs and production processes that can be made more flexible will be able to restructure their production schedules, optimise their costs and consequently become more competitive on the market.

The Covid-19 Market

The crisis that arose as a result of the coronavirus (COVID-19) pandemic has brought many challenges to all sectors of the Brazilian economy. In the electrical sector, we have seen effects such as:

- Lower energy consumption: with the imposed restrictions, industry and trade have drastically reduced their business. A comparison of the period from March 21st (beginning of the social restrictions measures) to May 8th for 2019 and 2020 shows an average reduction in electricity consumption of 11% (Source: CCEE). The official review of the load forecast for the 2020-2024 cycle indicates a reduction in consumption of 2,9% for the year 2020.

- Reductions in profit for the distributors, arising from a strong reduction in consumption and a high risk of an increase in default on payments.

- Requests for renegotiation of contracts in the free electricity market by industrial and commercial customers.

The government announced measures to maintain the sustainability of the sector, focusing, in the first instance, on distributors and low-income consumers. The most relevant measure was a loan negotiated with a syndicate of banks to cover the revenue deficit of the distributors and ensure these are passed on to other links in the chain, such as generators and transmitters.Compared to the rationing of 2001, the other extreme event that affected the country in this century, the recovery of the market after the COVID-19 pandemic should be faster. Some sector specialists believe that the recovery of the economy will be based on a strong investment program in infrastructure and privatization, as a means of attracting private capital.

Do you want to learn more about Energy Management & Optimization Systems?